The next time you hear people say they'll flee U.S. soil if so-and-so wins the presidential election, ask if they're familiar with the financial life of an expat.

Sarah O'Brien, special to CNBC

Financial advisors say that, regardless of the reason a person wants to move abroad, it's important to know that laws, tax obligations and banking policies can add complications to your personal finance picture.

"Find out if you will be able to transact financially in the foreign jurisdiction you're looking at," said certified financial planner Kashif Ahmed, founder and president of American Private Wealth. "It's a very serious thing to consider before just picking up and leaving the country."

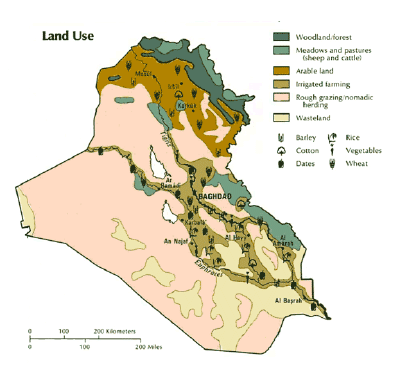

An estimated 8.7 million U.S. citizens already live abroad, scattered across more than 100 countries. For some of them, banking as an American has become more difficult since the U.S. government began relying on foreign financial institutions several years ago for help in its battle against money laundering and tax evasion.

"There are a lot of issues that Americans overseas face, and it isn't easy," said Marylouise Serrato, executive director of advocacy group American Citizens Abroad.

"We're trying to address some of [the complications] through regulatory change."

Specifically, Serrato's group is working to get changes made to the 2010 Foreign Account Tax Compliance Act.

Commonly called FATCA, it requires foreign financial institutions — banks, insurance companies, stock brokerages, hedge funds, trusts, etc. — to file formal reports about accounts held by American citizens, whether they live in the United States or abroad. The penalty for noncompliance is a 30 percent withholding on any U.S. investments held by the institution.

On top of the FATCA requirements, increased U.S. enforcement of existing know-your-client rules has led to higher compliance hurdles that some U.S. banks and brokerages have simply chosen not to face. Additionally, European regulation regarding some types of nonresident investments has chilled the mutual fund industry's interest in selling to Americans overseas.

The result has been a reduction both at home and abroad in banks willing to service accounts owned by a U.S. citizen.

"Banks are taking the logical defense: Is it worth it to us to maintain this client base when we have to make sure every one of them is compliant?" Serrato said.

While numbers of Americans affected are hard to come by, it's been enough to warrant attention from the Treasury Department, which met last year with Serrato's group to hear one solution to the reporting requirements.

The ACA supports modifying FATCA to allow a "same country exemption," which would exclude foreign accounts from reporting requirements if the account were held by a bank in the country where the person lives.

"Americans abroad might have an account that that the IRS considers offshore, but to the American it's not offshore, because they live where the account is held," Serrato explained.

She also said that, anecdotally, she's heard there's an uptick in talk among the group's members that their overseas mortgages are the latest thing to be affected by U.S. law.

In some countries, mortgages are renewable after a set time. And although the Treasury Department apparently has assured the international banking community that mortgages fall outside reporting requirements, some expats have faced mortgage cancellation at renewal.

"Because Treasury says mortgages aren't reportable, what we're seeing is only a fear issue," Serrato said. "Someone in the bank hierarchy has a fear that mortgages will somehow be included in reporting requirements."

FATCA also requires U.S. citizens with foreign financial assets above certain thresholds — depending on your tax filing status — to report those assets every year with your annual tax returns.

You can bank on it

And then there's the Foreign Bank Account Report, or FBAR. Expats with foreign bank accounts whose assets reach more than $10,000 during the year must file an FBAR, whether they owe any taxes or not.

Instituted in the 1970s, FBAR requirements were routinely ignored and unenforced until more recently as part of the government's crackdown. "You are really reporting everything on one form or another," Serrato said.

To avoid the troubles with banking, some expats make sure they maintain a U.S. address. But if it's not genuine, your bank will close your account if they find out.

A better idea might be to find a financial institution that caters to military and government employees abroad. American Citizens Abroad is one group whose membership includes access to the State Department Federal Credit Union, Serrato said.

Aside from banking issues, another aspect of life as an American expat can't be avoided: filing U.S. taxes. The United States is the only developed country that requires its citizens to pay income taxes even when they live overseas.

And while tax treaties with many countries can reduce or eliminate your tax burden, failing to file an annual return will incur interest charges and late-payment penalties. State tax returns might also need to be filed, depending on the rules of your state.

Also, be aware that even some foreign retirement plans that are set up similarly to individual retirement accounts aren't recognized as tax-exempt by Uncle Sam.

Also check the tax treaty with your new country to avoid surprises, like discovering that your tax-sheltered 529 college savings plan in America is subject to taxes in a different country.

While finances are only one aspect of life overseas, experts say preparing beforehand can save you myriad headaches after you've left America.

"Sit down with your tax or financial advisors," Serrato said. "Understand your tax obligations for the jurisdiction and the United States, and make sure your advisors can explain everything you need to consider [about your investments] before you move overseas."

— By Sarah O'Brien, special to CNBC.com