| Popular Articles |

The slow economic growth environment could turn into recession if Washington can't break the political gridlock and step up with meaningful fiscal reform, Allianz Chief Economic Adviser Mohamed El-Erian told CNBC on Wednesday.

Matthew J. Belvedere

"We have relied excessively on central banks," the former co-CEO of Pimco said on "Squawk Box," because the response to the 2008 financial crisis was "too cyclical" minded.

In other words, El-Erian thinks the Fed and its counterparts around the globe have kept the spigots of easy money flowing for too long, hoping growth will come around.

"We as a society fell in love with finance as the engine of growth," he said. "Up to 2008, we depended on private finance. Since 2008, we've depended on central banks. We have forgotten what it takes to growth an economy in an inclusive manner."

El-Erian believes quantitative easing and ultra-low interest rates have done all they can do, and the White House and Congress need to join the fight against stagnation by crafting structural reforms.

But so far, he said: "Politicians are not stepping up to the plate."

"If we're not careful we're going to take a turn where slow growth turns into recession," said El-Erian, who's been warning of the perils of the "new normal" for about seven years now, a phrase he coined while at Pimco.

The economist said these three structural steps could help spur stronger economic growth:

- Reform the tax code;

- Deal with pockets of over-indebtedness such as student loans;

- Embark on an infrastructure program to fix the nation's roads, bridges and transportation systems.

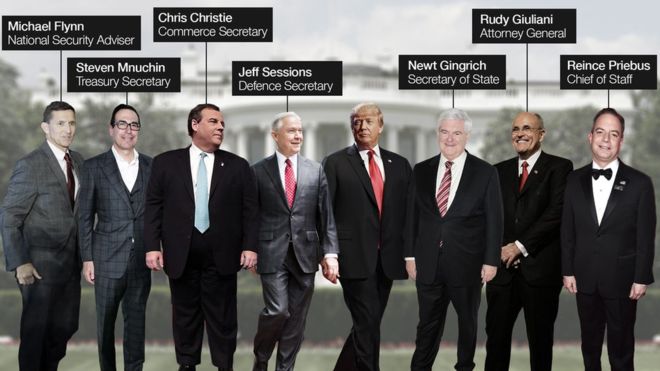

Investing in infrastructure has been a rare point of agreement between the Republican and Democratic presidential nominees, Donald Trump and Hillary Clinton, though they differ on how to do it.

Trump told CNBC last week it's time to "borrow long term" to fix to rebuild roads, bridges, and airports because interest rates are so low. Trump wants to spend nearly double than the $275 billion over five years that Clinton has proposed for infrastructure spending.

Matthew J. Belvedere, CNBC >

| More Articles |